Financial

Literacy

The Problem

ASU’s first-generation college students are underserved in terms of financial training. While upward mobility and financial skillsets are a driving force for why they are getting a Bachelor’s degree, ASU Local has yet to build substantive programming around the issue.

The Solution

The Financial Literacy project is an applied learning experience designed to help first-generation ASU Local students build confidence, language, and agency around money. By combining practical financial knowledge with reflection, culturally relevant scenarios, and learner choice, the project supports students in strengthening financial skills that align with their real lives and long-term goals.

This project was built using the ADDIE design process, grounding the experience in learner needs, iterative development, and continuous improvement.

Analysis

Design

Development

Implementation

Evaluation

Analysis

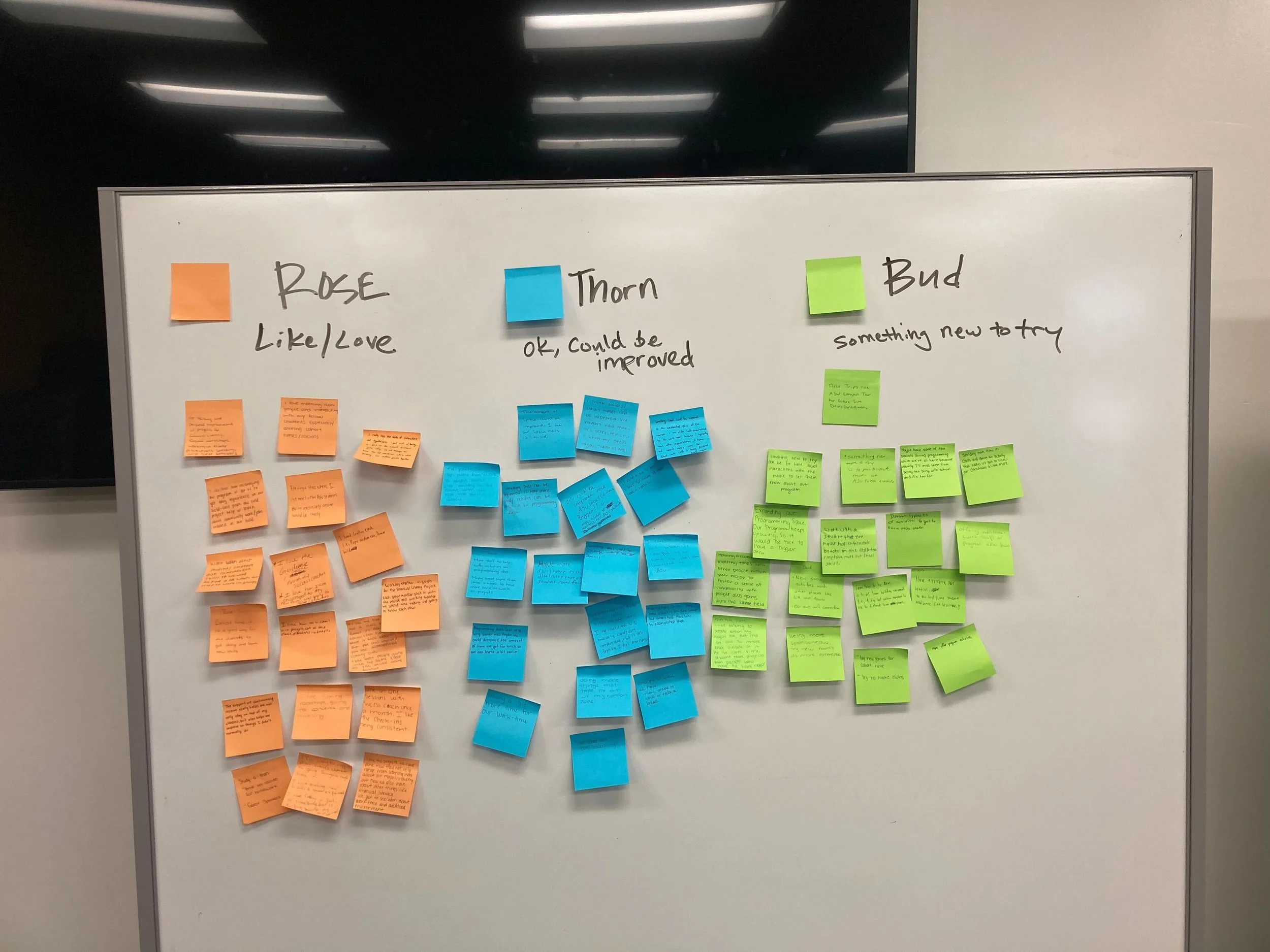

I began with empathy-driven research, facilitating curriculum feedback and ideation sessions with students at ASU Local sites in Los Angeles and Yuma. These sessions were intentionally interactive—designed to get students talking openly about money, confidence, and unmet needs.

To broaden perspective, I conducted additional 1:1 interviews and surveys with students at Washington, DC and Hawaii sites, capturing insights across geographies and learning contexts.

Before designing any sort of learning solution I gathered student feedback in lively group ideation sessions. ASU provides students with academic, career and wellbeing support, so I wanted to investigate student satisfaction and discover what their coaching needs were. I wanted to get students talking, laughing, thinking critically, and vocalizing their feedback. Students took ownership over their ideation pitches using a ‘creative matrix’ to push boundaries and think innovatively.

For students at our Washington DC and Hawaii sites, I completed additional ethnographic research in the form of 1:1 interviews and surveys to learn more about their hopes for ASU Local support.

Analysis Takeaways

Overwhelming amount of students are in the program to improve their family’s economic mobility

Financial literacy was one of the most urgent upskilling needs

Some wanted in-person facilitation and others desired opportunities for remote learning

Staff lack experience leading financial workshops, discussions & projects

Students like how culturally-relevant ASU Local curriculum feels and want it to go even further

(i.e. short videos, social media, guest speakers, experiential learning etc.)

Design

With a clearer understanding of student needs, it became evident that the experience needed to be financially focused, experiential, and confidence-building. I explored design directions by mapping possible learning pathways and interaction models, considering how students might move from foundational understanding to applied financial decision-making.

Grounded in learner research and instructional strategy, I defined learning outcomes that acknowledged students would enter the project with varying levels of financial knowledge. The design intentionally paired shared foundational learning with opportunities for autonomy, allowing students to deepen skills in a financial topic aligned to their interests and goals.

Project Learning Outcomes

Normalize talking about money through foundational topics & vocabulary

Explore & Analyze one’s money personality

Share financial best practices to emphasize their social capital

Become a subject-matter expert in one financial topic through research

Develop a slide deck to present to peers

Reflect on the project

Development

In the development phase, I designed a cohesive set of instructional materials that translated financial concepts into engaging, applied learning experiences. I curated and created resources, tools, and learning artifacts that supported student confidence and ownership, ensuring materials were accessible, relevant, and easy to facilitate.

The curriculum was intentionally built using a blended model, supporting both in-person and asynchronous delivery. This approach gave sites flexibility in implementation while maintaining consistent learning outcomes across contexts and student needs.

Implementation

During implementation, I led a nationwide rollout of the project by facilitating training sessions for coaches and site directors across ASU Local. These sessions focused on the project’s goals, deliverables, facilitation strategies, and the foundational financial concepts needed to support students effectively. To deepen readiness, I also met with coaches in 1:1 sessions to provide targeted guidance and address site-specific questions.

Drawing on my background in teaching and coaching, I developed a set of facilitation best practices to support high-quality delivery. These included scenario-based activities, collaborative challenges, guest speakers, and culminating presentations with stakeholders present—ensuring the experience remained engaging, applied, and confidence-building for students.

To support in-person facilitation, I shadowed implementation at the Los Angeles site, observing delivery in practice and gathering feedback to inform refinements to both the curriculum and facilitator guidance.

Evaluation

Successes

Site leaders, coaches, and students consistently reported that the addition of a dedicated financial literacy project filled a critical gap in the ASU Local experience.

Students demonstrated strong ownership over their learning through diverse final artifacts, including slide decks, conference-style posters, and videos—reflecting both creativity and personal relevance.

Many students translated their project work into professional assets, featuring deliverables on resumes, LinkedIn profiles, and digital portfolios.

Growth Areas

While foundational investment materials were included, some coaches and students expressed discomfort facilitating or engaging in deeper investment conversations (e.g., stock markets, Roth IRAs). Future iterations would benefit from additional coach training or co-facilitation with financial professionals.

Because the project used a pass/fail completion model, the quality of student work varied. Introducing a clearer rubric or exemplar-based assessment could support more consistent outcomes.

An employer-led workshop from MidFirst Bank added meaningful real-world context, but scheduling conflicts limited participation. Integrating employer engagement more directly into the core curriculum—or offering multiple sessions—would improve access and impact.

The project’s impact extended beyond a single cohort—today, the ASU Local Financial Literacy Upskilling Course is a required experience for all students before graduation.